Oil prices have climbed in recent weeks, spurred by concerns over supplies and geopolitical risks, including wars in Ukraine and the Middle East. Analysts say the momentum could carry prices higher.

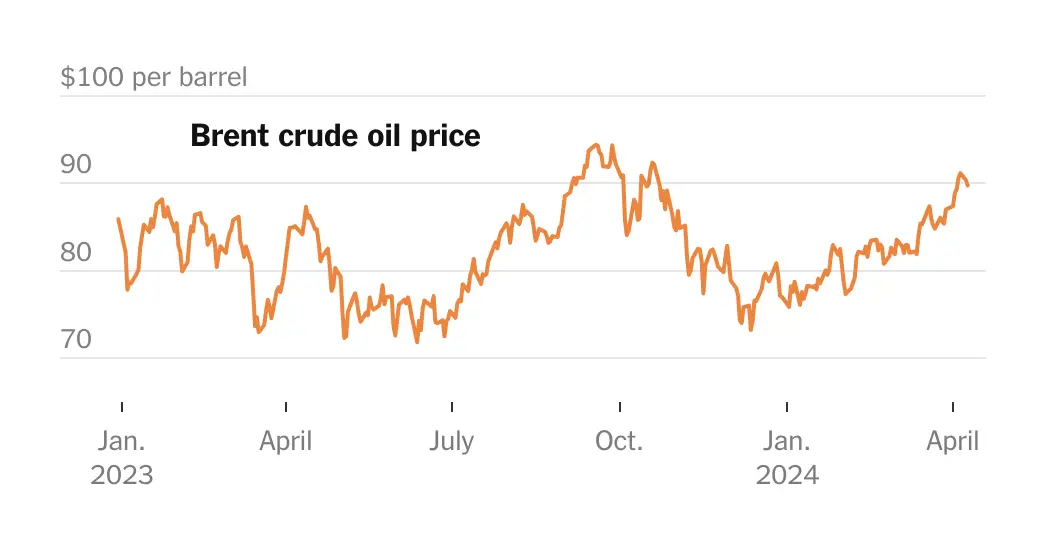

The price of a barrel of Brent crude oil, the international benchmark, has risen more than 20 percent since mid-December. It has jumped more than 10 percent over the past month alone, to around $90 per barrel. “The sentiment is really bullish,” said Viktor Katona, an analyst at Kpler, a commodities research firm.

Rising oil prices could make efforts by central banks to reduce inflation more challenging. In the United States, higher gasoline prices during the summer driving season would also be unwelcome for the Biden administration, which faces a difficult election in November. The average price at the pump has risen about 50 cents per gallon since early January, to around $3.70, according to the Energy Information Administration.

Market watchers note that a short-term retreat in prices, after such a rapid rise, is also possible. The oil price also remains below the peaks reached in 2022, when prices jumped well above $100 a barrel.

In 2023, strong growth in crude output from the United States, the world’s largest oil producer, and other countries outside the Organization of Petroleum Exporting Countries helped reassure markets that there would be enough oil to slake demand. Prices remained subdued for much of the year despite the threats posed by geopolitical tensions. Initially, markets largely shrugged off the risks posed by the conflict between Israel and Hamas.

But 2024 looks like a very different year. Demand has been stronger than some analysts expected. And a series of potentially disruptive events — along with production cuts by Saudi Arabia and its allies — have raised worries of a potential supply squeeze.

The most unsettling development was the killing of a group of Iranian Revolutionary Guard commanders in an airstrike in Damascus, Syria, on April 1. Iran pledged to retaliate, raising fears that its actions could pull key exporters in the Persian Gulf into the conflict, which began with the Hamas attack on Israel in October.

“That’s always been the fear since Oct. 7, the direct confrontation between Iran, the U.S. and Israel,” said Jim Burkhard, vice president and head of research for oil markets, energy and mobility at S&P Global Commodity Insights.

The Middle East conflict has had little effect on oil supplies so far, Mr. Burkhard said, but markets will be on edge until they see how the face-off between Israel and Iran plays out.

The continuing effort by the group of oil producers known as OPEC Plus to limit oil supplies adds to the edginess. Largely orchestrated by Saudi Arabia’s oil minister, Prince Abdulaziz bin Salman, these production trims are removing around five million barrels a day, or potentially around 5 percent of supply, from the market.

There is always skepticism about whether OPEC will stick to its commitments, but it is dawning on the markets that these cuts may not be relaxed anytime soon unless prices rise substantially. “We don’t expect a formal increase out of OPEC Plus unless prices are above $100” a barrel, Mr. Burkhard said.

Instead, the Saudi-led group has focused on signaling its resolve. In March, several members announced the extension of production cuts through June. To drive the point home, OPEC Plus said in a news release on April 1 that two of its members, Iraq and Kazakhstan, had agreed to “compensate for overproduction.”

The Middle East is not the only potential source of disruption for oil markets. Russia has been making slow gains in its war with Ukraine, while Kyiv has figured out how to use drones and missiles to inflict significant damage on Russian oil infrastructure, at least temporarily reducing Russia’s ability to produce products like diesel and gasoline.

Ukraine’s aim is apparently to try to reduce the revenue Russia has available to fund the war, but the impact could be felt in world petroleum markets. Knocking out plants “tightens up” the global trade in energy products, said David Fyfe, chief economist at Argus Media, a commodities research firm. “That is helping juice up crude prices as well.”

Analysts say a further lift may come in the summer, when seasonal demand is typically high as people take to cars and planes for vacation trips.

Tensions could come to a head in early June when the ministers from OPEC Plus plan to gather in Vienna to decide how much oil to put into the market. Some members of the group may want to see an increase in production, but the Saudis are likely to resist, analysts say.

Richard Bronze, the head of Energy Aspects, a research firm, said, “The Saudis are setting their policy on what they think is right for the oil market and their budget, and there is very little leverage that Washington has at present to get them to consider loosening.”