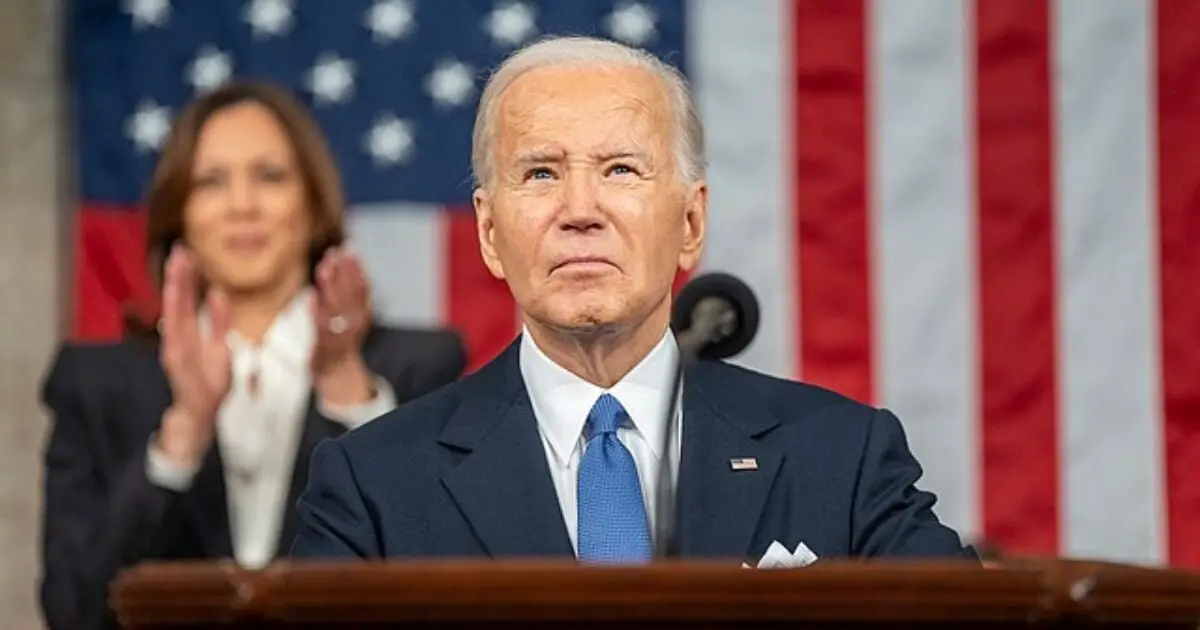

President Biden is very concerned about how to get more money from working Americans and redistribute it to non-working and non-taxpaying people, both foreign and domestic.

He does not seem concerned about reducing his spending, stopping the funding of illegal immigrants, giving away money to Ukraine, or getting people off of welfare. Instead, the fix he came up with in the State of the Union Address was a proposed 25% tax on America’s billionaire households.

The top income tax rate currently is 37%, assessed on income of $346,876 for a married couple filing separately. Therefore, high-income individuals are already paying more than 25%.

He also claimed that “under my plan, nobody earning less than $400,000 will pay an additional penny in federal taxes.” So, at a glance, it seemed like he would continue to tax people with less than $400,000 income at a 37% rate but would tax people earning more than $400,000 at a rate of 25%, which makes no sense.

When you look more closely at his wording, however, the rate is not based on income but on accumulated wealth, violating the definition of the term “income tax”.

The “tax the rich” mantra surfaces during every Democratic administration, generally more than once. And the justification is always that X percent of the wealthiest families only paid a low income tax rate of Y, “And that just ain’t right.”

According to a 2021 White House study, the top 400 richest families paid an average income tax rate of 8%. During the speech, Biden claimed that the average billionaire only paid 8.2% federal income tax, which is not consistent with the White House study, which only looked at the 400 richest families, not all billionaires.

The study was also horribly flawed, as it counted unrealized capital gains as income, which is not consistent with current tax law.

The IRS, which would presumably have better data on taxes, determined that the top 1 percent of taxpayers paid an average federal income tax rate of 26 percent.

But even if the White House had been correct that people with high wealth paid low income tax rates, there is no taxable connection between wealth and income.

Wealth is defined by the accumulation of assets, whereas you only pay income tax on income. So, unless we are going to become a communist country that forcibly seizes the assets of the rich and gives them to the poor, then we need to avoid joining Biden on this first step down the slippery slope to serfdom.

The White House study including unrealized capital gains in their income calculations was a subtle nudge to get the public to accept a new tax law.

In previous speeches, Biden proposed taxing unrealized capital gains. But under US law, you only pay tax on capital gains when you realize them. You do not pay tax on the appreciation of your home or your retirement account until you sell it.

Until then, it is just a paper gain and could as easily turn into a paper loss before the time comes to cash it in.

If unrealized capital gains were to be taxed, assets would have to be appraised each year, and a tax would be calculated based on appreciation.

If you did not have enough money to pay the tax, you would have to sell off assets until the tax was covered. To be fair, if Biden wants to tax you when your assets go up in value, will he also give you a tax credit when they go down?

If the stock market has a bad year, should the government send you a check? Imagine someone saying, “Man, I wish I had picked some bad stocks because I could really use some cash right now.”

While we are on the subject of home values, Biden wants to help Americans buy a home and ostensibly tax them on the appreciation. Consequently, he wants to provide a $400 monthly tax credit for first-time homebuyers.

The issue is that this will increase demand for homes, which will drive up prices. The price will increase by the amount people can afford to pay, which is $400 a month.

He also wants to crack down “on big landlords who break antitrust laws by price-fixing and driving up rents.” Government legislation that reduces rents removes the incentive to build new rental units, which decreases the supply and drives up the price, hurting renters.

If the government implements a rent cap, then the result will be a shortage. Either way, renters will suffer.

Working Americans would have to cover the $400 tax credit given to homebuyers. So, the takeaways from the State of the Union address are that the president hates rich people, working people, homeowners, and renters.